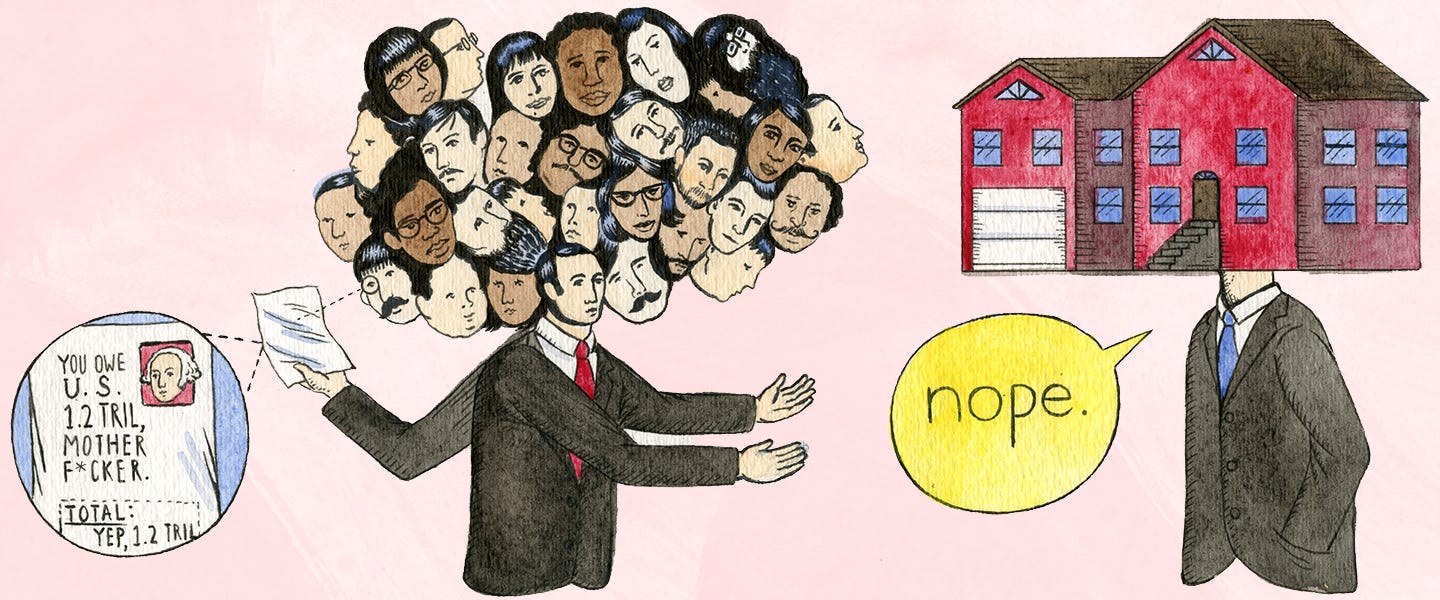

Mel Magazine has an interesting conjecture on what would happen if all student debt suddenly went into default. As you might imagine, with something on the order of $1.3 trillion involved it would probably be at least an order or two of bad.

Not only do the people in debt suffer (credit ratings, legal actions etc), various institutions lose the asset represented in a promissory note of what ever type. An income generating asset that both helps fills the book value of an institution, and serves as a node in the great matrix of capital creation. When book values suddenly disappear the ability to secure notes of its own disappear, along with previously relied upon income.

Consumption and debt are part and parcel of Capitalism of course, and have always been a tricky balancing act in keeping one or the other from extremes. Debt in the consumption of education services, however, is a particularly troublesome sub set of that balancing act; especially as ever increasing competition works the double whammy of both increasing technological development, and the need for more technically skilled workers. Wherein we get the equally increasing drum beat for ongoing retraining as innovative "disruption" makes the new old faster and faster. It doesn't take precognitive ability to see the future to understand that this arrangement may lead to an ever accumulating debt load, even after the initial instructional consumption.

To say that serving the starting debt load is bad now hardly begins to cover what it might become a decade from later. And what then? If you think defaulting on the debt now might be bad, would pushing a possible default down the road a ways make it any better? Probably not, especially as it might complicate an individuals ability to service the other types of consumption based debt accumulated in the interim. And then you have to factor in the way the cost of education itself keeps increasing. Are we to suppose that's going to go away soon?

What we are describing here is just another of the contradictions of an electrified from of Capitalism. Information is money in this hybrid, and passing it along from one point of use to another, whether to impart a skill, or to utilize it in direction production, is to incur a new aspect of net gain at each point. How long do you suppose it's going to be before the cost of imparting it to humans will become quite cost ineffective, just as having humans perform direct production has already become more and more inefficient. But then, if you're not going to train humans, or use them much in production, the question comes back to who will be left capable of affording to buy any of what this ever more efficient techno-productive machine is capable of producing?

It's here where I usually fall back to the metaphor of fault lines; similar to geophysical faults, only in this case within a very large, and complex, system of human interaction. These fault lines have been building up pressure. We've tried to take measures to ameliorate, or divert, the pressures in these faults, but not remove them altogether. To do that would require starting over with an entirely new system. So the pressures build. We keep building up structural elements on top of them, despite the growing danger, and hope that a new patch, or diversion will buy us more time. The ultimate outcome, though, is inevitable.

The take away here is this. When you think about the question of default, or starting over completely for that matter, and how bad it might be, just remember: putting it off till later may well be a sure prescription for making it a hell of a lot worse.

What Would Happen If We All Stopped Paying Our Student Loans?

No comments:

Post a Comment